Evaluating Retirement Preparedness and Confidence Among LGBTQ Americans

By: Greenwald Research

10/21/2021The Annual Retirement Confidence Survey (RCS) gauges the attitudes and outlook of working-age and retired Americans regarding retirement, their preparedness for retirement, their confidence regarding different aspects of retirement, and other related issues. With more than 30 years of compelling findings, the RCS is widely cited and is the longest-running survey of its kind.

This year’s RCS, led by Greenwald Research and the Employee Benefit Research Institute (EBRI), aimed to identify trends in retirement preparation and assess confidence levels of its 3,017 Americans with a focus on Black and Hispanic respondents. The survey was conducted online in January 2021 and asked additional questions on gender and sexual orientation, with 222 LGBTQ consumers being identified. The LGBTQ sample included 149 workers and 73 retirees.

Core Topics Covered in the 2021 RCS

- Personal perspectives on ability to achieve secure retirement

- Overall impact and burden of lower asset, income, and debt levels

- Trust in financial service institutions and reliance on other sources

- Effect of COVID-19 on retirement savings and other financial plans

Interaction between supporting family and saving for retirement. In preparation for the 2022 RCS, which will focus on a larger sample of Americans identifying as LGBTQ, we’ve analyzed some of this year’s data. The following themes emerged and may provide a picture of potential findings to look for in the 2022 survey.

Key Findings: Confidence Levels, Savings & More

Key Findings: Confidence Levels, Savings & More

Feeling confident and secure in retirement often correlates strongly with income and the availability and accessibility of financial resources. Knowing that resources can vary greatly for different populations and demographics, Greenwald and EBRI researchers are always careful when drawing conclusions about study results.

High levels of confidence in savings and retirement preparedness reflect a general feeling of optimism within the LGBTQ community. However, not all LGBTQ retirees feel optimistic, as issues like living in a one-income household and addressing concerns related to debt remain prevalent.

Retirement Confidence & Income

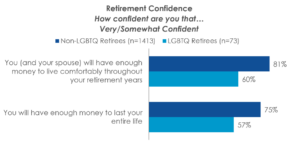

Overall, LGBTQ consumers’ retirement confidence is high, but LGBTQ retirees are less confident than non-LGBTQ retirees. 7 in 10 LGBTQ consumers are confident that they will have enough money to live comfortably in retirement, which is on par with the total population. Roughly 7 in 10 say they are confident that they will have enough money to take care of basic and medical expenses, and that they did a good job of financially preparing for retirement.

Overall, LGBTQ consumers’ retirement confidence is high, but LGBTQ retirees are less confident than non-LGBTQ retirees. 7 in 10 LGBTQ consumers are confident that they will have enough money to live comfortably in retirement, which is on par with the total population. Roughly 7 in 10 say they are confident that they will have enough money to take care of basic and medical expenses, and that they did a good job of financially preparing for retirement.

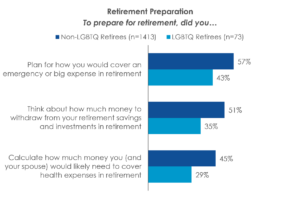

However, LGBTQ retirees are less confident than non-LGBTQ retirees, as only 6 in 10 believe that they’ll have enough money to live comfortably in retirement and that their money will last their entire life. These retirees are also less likely to have:

- Planned for how they would cover emergency or large expenses in retirement

- Thought about how much money to withdraw from retirement savings in retirement, and

- Calculated how much money they would need to cover health expenses in retirement

This lower confidence in retirees could be attributed to 7 in 10 LGBTQ retirees saying they are not married and therefore living in a one-income household. Very few, only 6%, indicate that they are unmarried but living with a partner. Less than half of non-LGBTQ retirees say they are not married.

While these consumers feel they will be able to manage their money in retirement, they are stressed about preparing for it. At least 7 in 10 say they are confident in their ability to manage day-to-day finances as they age and to choose the right retirement products or investments. Though this confidence is high, 6 in 10 report feeling stressed due to preparing for retirement. This stress could stem from the fact that only 4 in 10 LGBTQ consumers say that they have figured out how much money they’ll need to have saved by retirement or have estimated how much income they would need each month in retirement, significantly fewer than non-LGBTQ consumers.

Retirement Confidence & Debt

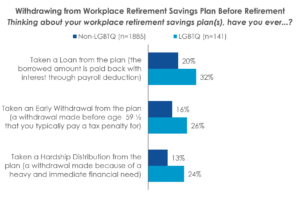

LGBTQ workers are utilizing their employer-sponsored retirement savings plans but some are also withdrawing those funds before reaching retirement. 75% of LGBTQ workers are offered a retirement savings plan by their employer and nearly 9 in 10 who are offered a plan are currently contributing. Interestingly, fewer combined workers and retirees say they have used money in a workplace retirement savings plan to save or prepare financially for retirement (38% vs. 49% non-LGBTQ). This could be likely because more LGBTQ consumers than non-LGBTQ consumers say they have taken a loan, an early withdrawal, or a hardship distribution from their plans.

LGBTQ workers are utilizing their employer-sponsored retirement savings plans but some are also withdrawing those funds before reaching retirement. 75% of LGBTQ workers are offered a retirement savings plan by their employer and nearly 9 in 10 who are offered a plan are currently contributing. Interestingly, fewer combined workers and retirees say they have used money in a workplace retirement savings plan to save or prepare financially for retirement (38% vs. 49% non-LGBTQ). This could be likely because more LGBTQ consumers than non-LGBTQ consumers say they have taken a loan, an early withdrawal, or a hardship distribution from their plans.

One of the reasons for withdrawing these funds earlier could be to address debt. 3 in 5 feel that their current level of debt is a major or minor problem. While this is comparable with non-LGBTQ consumers, LGBTQ consumers more often say that their non-mortgage debt has a negative impact on saving for emergencies, saving for retirement in general, and that debt is negatively impacting their ability to save for or live comfortably in retirement.

Retirement Confidence & Trust

Experiences with financial professionals are generally positive, consistent with the population at large, and advisors are among the top sources of retirement planning information. 66% of LGBTQ consumers agree that they have been treated fairly by financial services companies and 6 in 10 believe that these companies understand how to help them with retirement and financial planning.

The top sources of information that these consumers trust for retirement planning are family and friends, online resources from their own research, and their financial advisor. 3 in 10 LGBTQ consumers work with a financial professional, and in their search for an advisor to work with, they prioritize someone with expertise in their goals, who specializes in households with similar assets, and has previously worked with a friend or family member.

Looking Toward the 2022 Survey

While the 2021 Retirement Confidence Survey was able to uncover a few findings regarding LGBTQ consumers’ feelings toward retirement, the number of LGBTQ consumers surveyed was low, and questions were primarily geared towards Black and Hispanic populations.

However, there are definite opportunities for further research into how LGBTQ Americans are preparing for and living in retirement. For the 2022 RCS, Greenwald and EBRI aim to delve deeper into the experiences these consumers are having with retirement savings and income, the financial services industry, and what they are looking for in an advisor and retirement planning tools.

The 2022 iteration of this survey will focus on a larger sample of LGBTQ Americans to produce additional insights that can help professionals better identify and serve this community’s needs. Visit www.greenwaldresearch.com/rcs or contact us to learn more about or sponsor the 2022 RCS.