Health Plan Enrollees Spend Little Time Selecting a Plan, and are Largely Satisfied with Enrollment

By: Greenwald Research

3/22/2023Our 18th Annual Consumer Engagement in Health Care Survey (CEHCS) was conducted during open enrollment season in the fall of 2022. Greenwald Research and the Employee Benefits Research Institute (EBRI) have partnered on the study since 2005. Organizations supporting this year’s study include Blue Cross Blue Shield Association, HealthEquity, Inc.; Millennium Trust Company, Segal, TIAA, UMB Financial and Voya Financial.

Major findings of the report (available here) include:

Happy with Open Enrollment, Most Enrollees Spend Less than an Hour Choosing a Plan

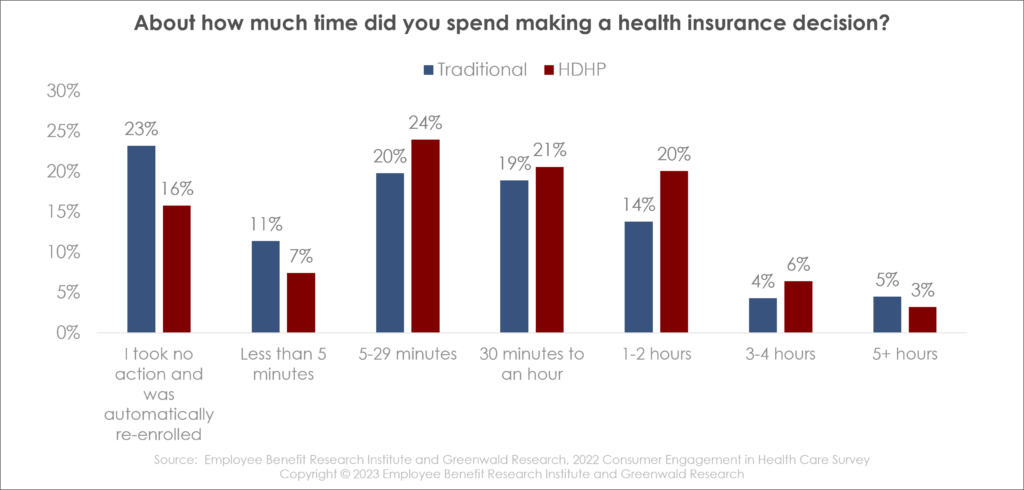

Ninety percent of private health plan enrollees report that they’re satisfied with open enrollment (58% extremely or very satisfied, 32% somewhat satisfied). Nearly three-quarters (72%) of enrollees make their choice in under 60 minutes, including one in five who selected automatic re-enrollment.

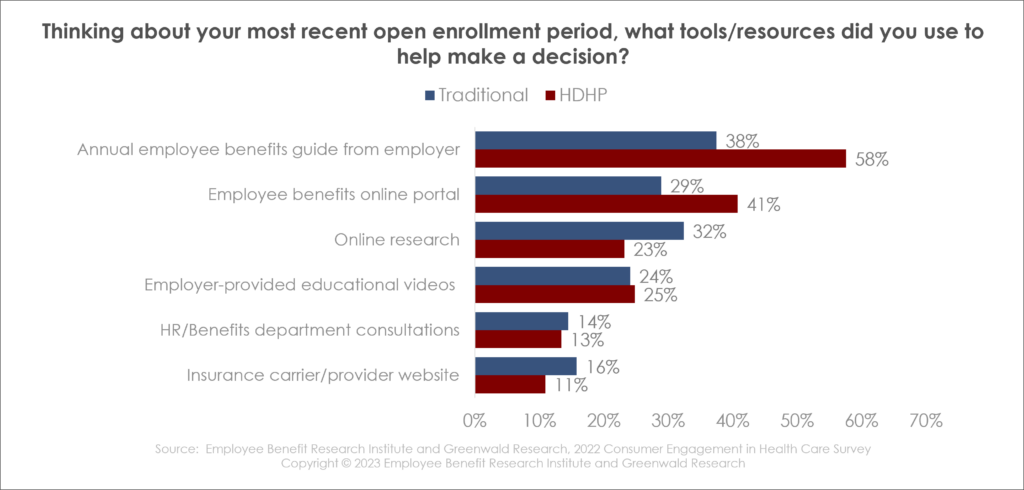

High deductible health plan (HDHP) enrollees spend more time than traditional plan members, and they were more likely to use their annual employee benefits guide (58%) and their online portal (41%). Only 38% of traditional plan enrollees used their employee benefits guide, and just 29% used their online portal.

What’s Important in Making the Choice

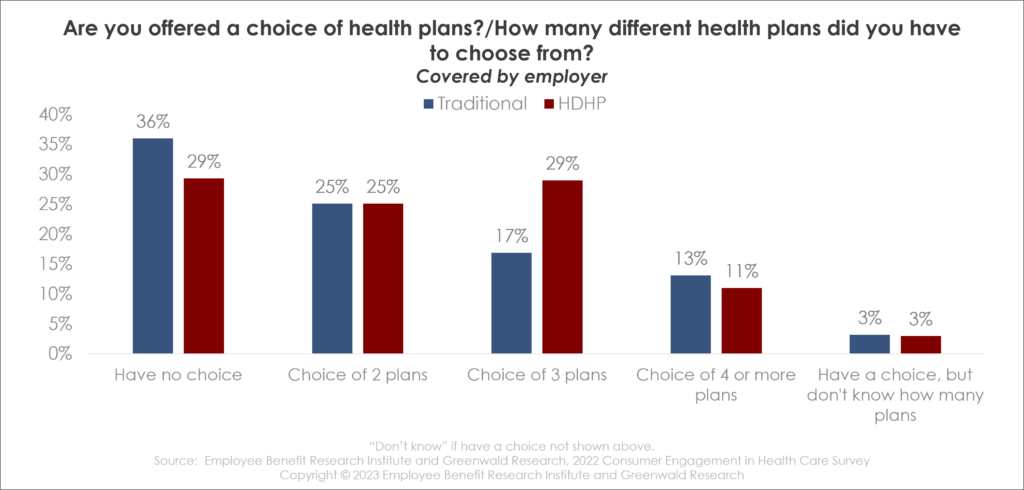

About six in 10 respondents reported they have a choice of health plan, with HDHP enrollees having more plans to choose from on average. Forty percent of HDHP enrollees had three health plans to choose from, compared to 30% of traditional plan enrollees.

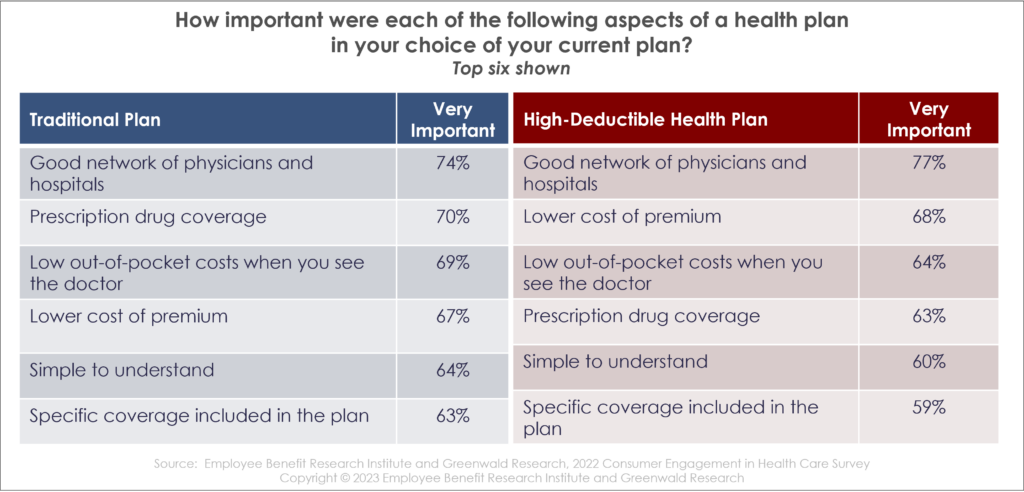

Plan characteristics enrollees cited as important: the network of health care providers, low out-of-pocket costs, low premiums, prescription drug coverage and ease of understanding the plan. Traditional and HDHP enrollees ranked these in the same order, with one exception: as one might expect, traditional plan enrollees put greater weight on low out-of-pocket costs for doctor’s visits and less on low premium costs. On the other hand, HDHP enrollees put a higher priority on low premiums than low out-of-pocket costs when selecting a plan.

CDHP Enrollment Up, HDHP Enrollment Down

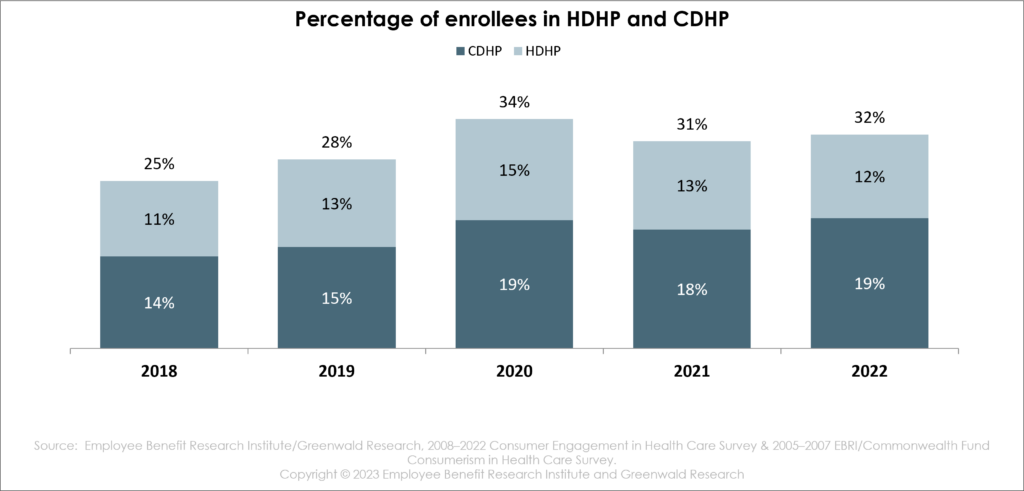

Enrollment in Consumer-Driven Health Plans (CDHP) – that is, enrollment in health savings account (HSA)-eligible health plans, reached a record high of 19% in 2020, dipped in 2021, and increased back up to 19% in 2022. Enrollment in high deductible plans that are not HSA-eligible fell from 15% in 2020 to 12% in 2022.

The Impact of Higher Health Care Costs

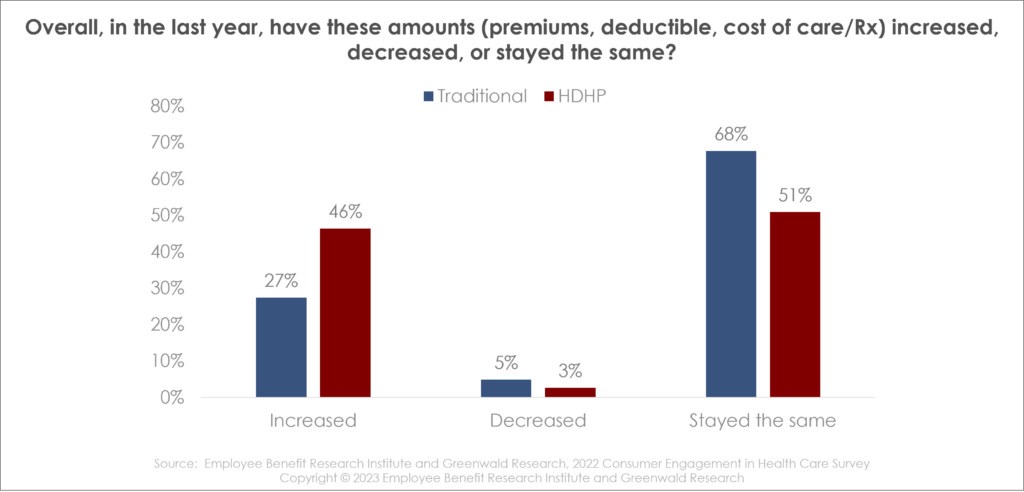

Nearly one-third of enrollees report that premiums and out-of-pocket costs have increased over the past year. HDHP enrollees are more likely than traditional plan employees to report higher out-of-pocket costs. However, traditional plan employees were more likely to report being affected by increased health care spending. Over the past year, higher health care costs have impacted aspects of personal finances – including non-health care spending and use of medical services. Many individuals have reduced discretionary spending, decreased savings and delayed going to the doctor.

The Power of Preventive Care

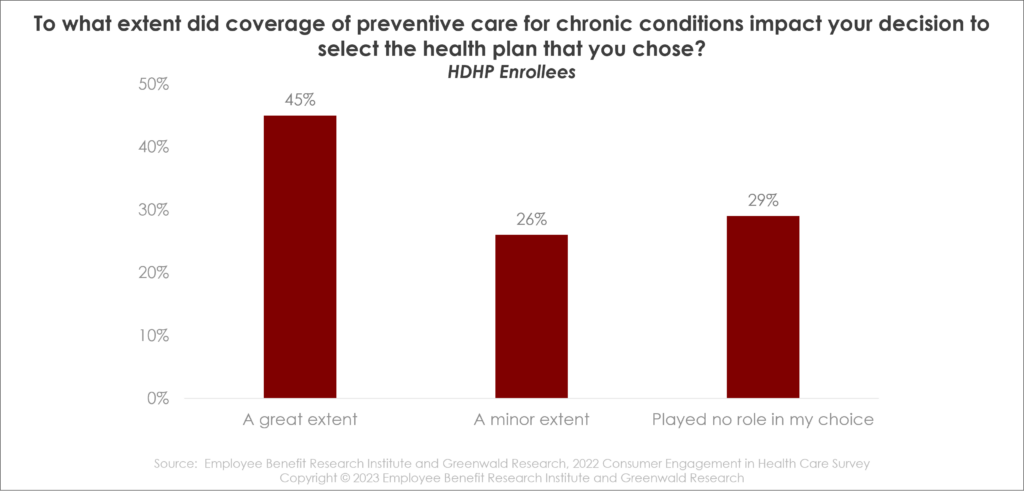

Seventy percent of HDHP enrollees report that pre-deductible coverage of preventive care for chronic conditions impacted their decision to select the HDHP (45% say it impacted their decision to a great extent, while another quarter indicate it impacted their decision to a minor extent).

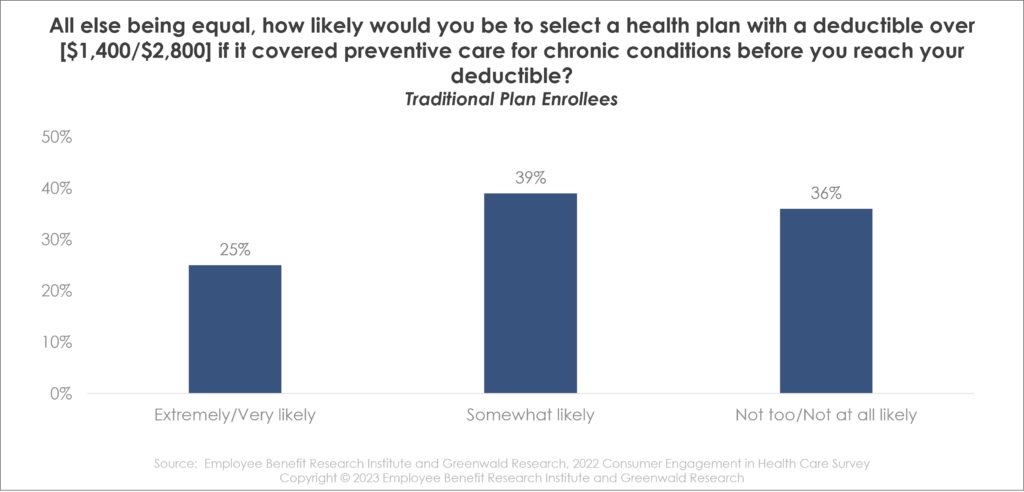

And more than two-thirds of traditional plan employees say they are likely to select an HDHP if it covered preventive care for chronic conditions before they reach their deductible. One quarter are extremely or very likely to select an HDHP for those reasons, while another 39% say they are somewhat likely. This high likelihood of traditional plan enrollees to select an HDHP with strong preventive coverage, coupled with mostly similar HDHP plan enrollment in the past 3 years may indicate a knowledge gap among consumers: are they truly aware of some of the benefits of HDHPs?

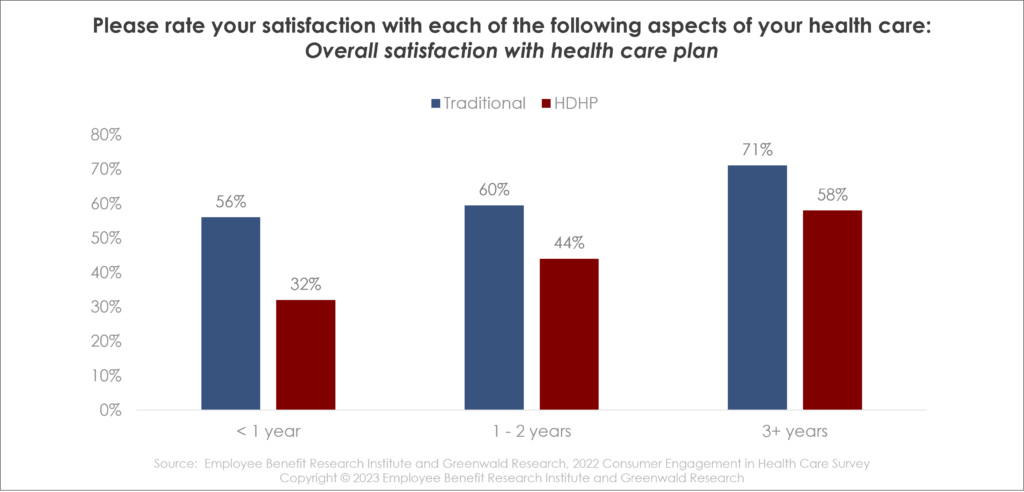

Satisfaction with Plans – Time is on Your Side

Enrollees’ overall plan satisfaction is positively correlated with the length of time they’ve had the plan. Among enrollees in traditional health plans, those reporting satisfaction increased from 56% in the first year to 60% in the second year to 71% in the third year. Among HDHP enrollees, 32% said they were satisfied in the first year, 44% in the second year and 58% in the third year. This may indicate a learning curve in feeling comfortable using a new plan.

About the Survey

The Consumer Engagement in Health Care Survey (CEHCS) is a survey of privately insured adults conducted by the Employee Benefit Research Institute (EBRI) and Greenwald Research, an independent research firm. The survey has been conducted annually since 2005. The CEHCS provides reliable national data on the growth of consumer-driven health plans and high-deductible health plans and their impact on the behavior and attitudes of health care consumers.

The 2022 survey of 2,015 individuals was conducted using Dynata’s online research panel between Oct. 17 and Nov. 20, 2022. All respondents were between the ages of 21 and 64.

The national sample is weighted by gender, age, income, ethnicity, education, and region to reflect the actual proportions in the population. The consumer-directed health plan (CDHP) and high-deductible health plan (HDHP) samples are weighted by gender, age, income, and ethnicity.