Life’s Persistent Questions #1: When is the Best Time to Buy Life Insurance?

By: Eric Sondergeld

5/19/2023Two of the biggest questions consumers look to answer when considering life insurance are What kind should they get (such as term or permanent)? and How much do they need? A third question that perhaps should come first is When should someone purchase life insurance?

I recently saw a post on LinkedIn that said the time to purchase life insurance is when your health is at its best. I admit this sounds like good advice, as people tend to be healthier when they are younger, are more likely to qualify for insurance when their health is at its best, will pay lower premiums, and will have insurance in case they later become uninsurable. Case closed, right?

Not so fast. How do we know when our health is at its best? What if someone’s health was better in the past than it is today? How is someone to know whether their health will end up improving over time? In other words, we don’t know when we are in our best health.

Similarly, investors are told to buy low and sell high. As with our health, it’s difficult to know whether an investment’s value will increase or decrease after buying or selling it. Again, it’s great advice to buy low and sell high, but difficult to pull off.

Further complicating matters, a theoretical measure of health should account for age. So, “best health” may be relative. For example, to qualify for preferred underwriting status, a life insurance company may have different guidelines depending on age, such as forgiving some minor health issues of an older applicant, provided they’re under control and don’t pose a serious health issue. In other words, in defining whether someone qualifies for standard or preferred underwriting, they compare them to others of the same age.

I believe the best time to buy anything – including life insurance – is when you need it. While there is some merit to the argument that you should buy some coverage when you’re young (and healthy), perhaps even adding a guaranteed insurability rider so that when you have a need for (more) coverage later, you can get it even if your health has deteriorated. But this can also be a tough sell and can lead some to feel the company or agent making that argument is just trying to sell them something they don’t need right now.

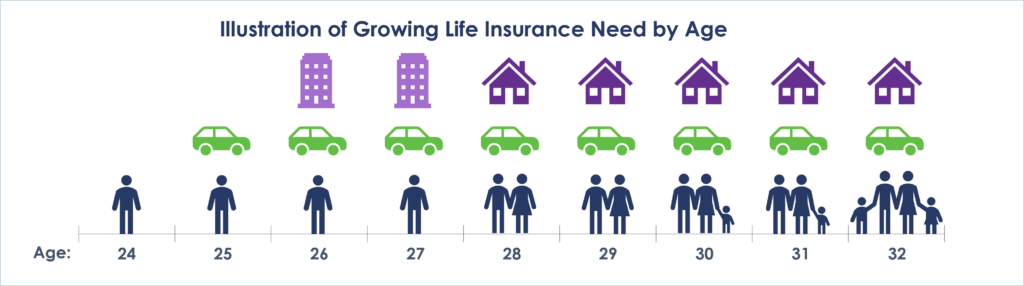

Let’s walk through an example of a 24-year-old male just starting his career. He is single, has no debt, and hasn’t started a family. Should he buy life insurance? Does he have a current need? Not according to most life insurance needs calculators. He buys a $25,000 car next year so he can get to and from his new job and takes out a 5-year loan to finance it. The following year he buys a modest one-bedroom condominium for $100,000 and takes out a 20-year loan in order to purchase it. Two years later, he marries his childhood sweetheart. He sells the condo, and they pool their resources to purchase a 3-bedroom home for $300,000. Their combined incomes qualified them to take out a 30-year loan to finance this purchase. Two and four years later, they have a girl and then a boy.

From this description, it is obvious that he (and his wife) has a life insurance need. That need didn’t arise in one day. Rather, it emerged over time, as he took on debt and family obligations. At what point(s) in that 8-year journey should he have purchased life insurance? I intentionally didn’t mention his health and when his health may have been at its best. His health could have remained constant, improved, or worsened during this time, any of which he couldn’t have predicted with certainty when he was 24.

The above example suggests that determining the best time to buy life insurance isn’t as straightforward as “when you’re at your best health” or, as I suggested, “when you need it,” since that need may start out very small and build over time. When is the need sufficiently meaningful that someone should buy life insurance? And since needs change over time, at what point(s) should someone revisit how much they need and adjust their coverage level accordingly?

If you’re interested in understanding the drivers and need for life insurance and when consumers believe they should buy life insurance, contact us.