The Retirement Confidence of Caregivers

By: Marie Ammar and Sara Rubinstein

10/16/2023

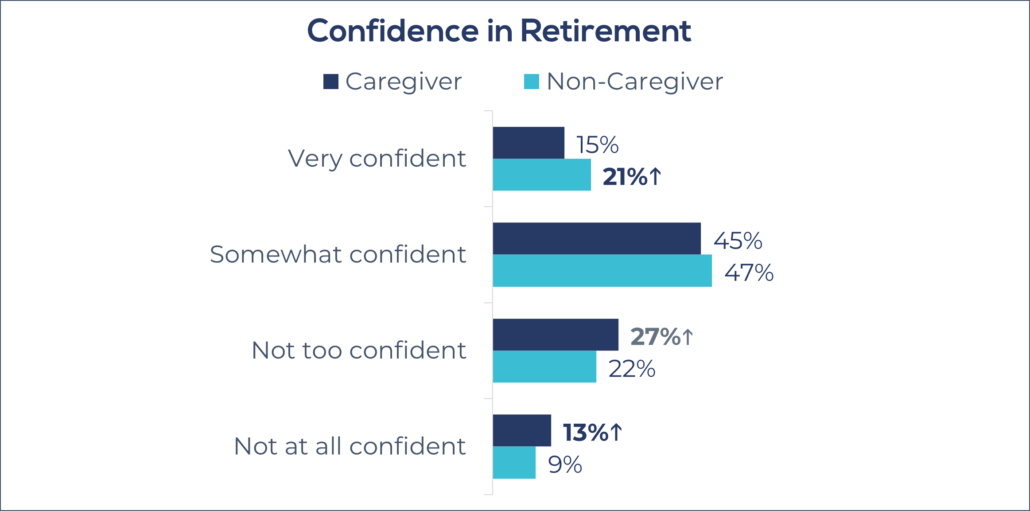

Consumer confidence in having enough money to live comfortably throughout retirement has significantly dropped this year and returned to levels last seen in 2018. The last time we saw a decline in confidence of this magnitude was in 2008 during the global financial crisis. And while workers and retirees alike are feeling this downward shift in confidence, some consumers are experiencing it more than others, namely caregivers. The results from the 2023 Retirement Confidence Survey, conducted with the Employee Benefits Research Institute, show that unfortunately only six in ten caregivers are confident in their financial security during retirement compared to 68% of non-caregivers.

What could be contributing to caregivers’ extreme lack of confidence? The answer might seem a little obvious: money. Caregivers tend to have more expenses than non-caregivers due to their caregiving responsibilities. Half of caregivers provide financial support to their care recipient, with nearly a third of them providing $5,000 to $14,999 in the past year. Caregivers, even those working, experience financial strain from providing care. Data from National Alliance for Caregiving (NAC) and AARP’s Caregiving in the U.S. 2020, conducted by Greenwald, tells us that six in ten working caregivers feel at least some level of financial strain, including two in ten who rated their strain a 4 or 5 out of 5.

Caregivers’ Finances

But where are caregivers finding the finances to provide this support? Caregivers’ household incomes are not higher than the average consumer; in fact, they tend to be lower. On top of that, nearly half of caregivers say their unpaid caregiving role and responsibilities prevent them from working the hours they want or need. Since caregivers are not receiving the income they truly need from their jobs, they must turn to alternative sources.

Caregivers are more likely to partake in “gig” work, where they earn money from websites or mobile apps that connect them to people who want to hire them. However, gig work isn’t exactly a steady income and sometimes caregivers have to rely on others for support. More than one in five report they have taken on new or additional debt and/or borrowed money from family or friends as a result of being an unpaid caregiver. Knowing this, it might come as no surprise that caregivers (64%) are more likely to have a debt problem than non-caregivers (52%). We see similar results in Caregiving in the U.S. 2020.

Looking closer at how caregivers’ finances, or lack thereof, are impacting their retirement savings, we can see that saving for retirement has been put on the backburner for many caregivers. A third of caregivers agree that saving for retirement is not a priority relative to the current needs of their family. This sentiment is visible as significantly more caregivers than non-caregivers report they have not saved any money for retirement (33% vs. 28%). Even their general savings are lacking, as one-quarter of caregivers have less than $1,000 in savings and investments compared to 15% of non-caregivers. As a result of providing care, three in ten working caregivers stopped saving, a quarter used up personal short-term savings, and one in eight used up their long-term savings (Caregiving in the U.S. 2020).

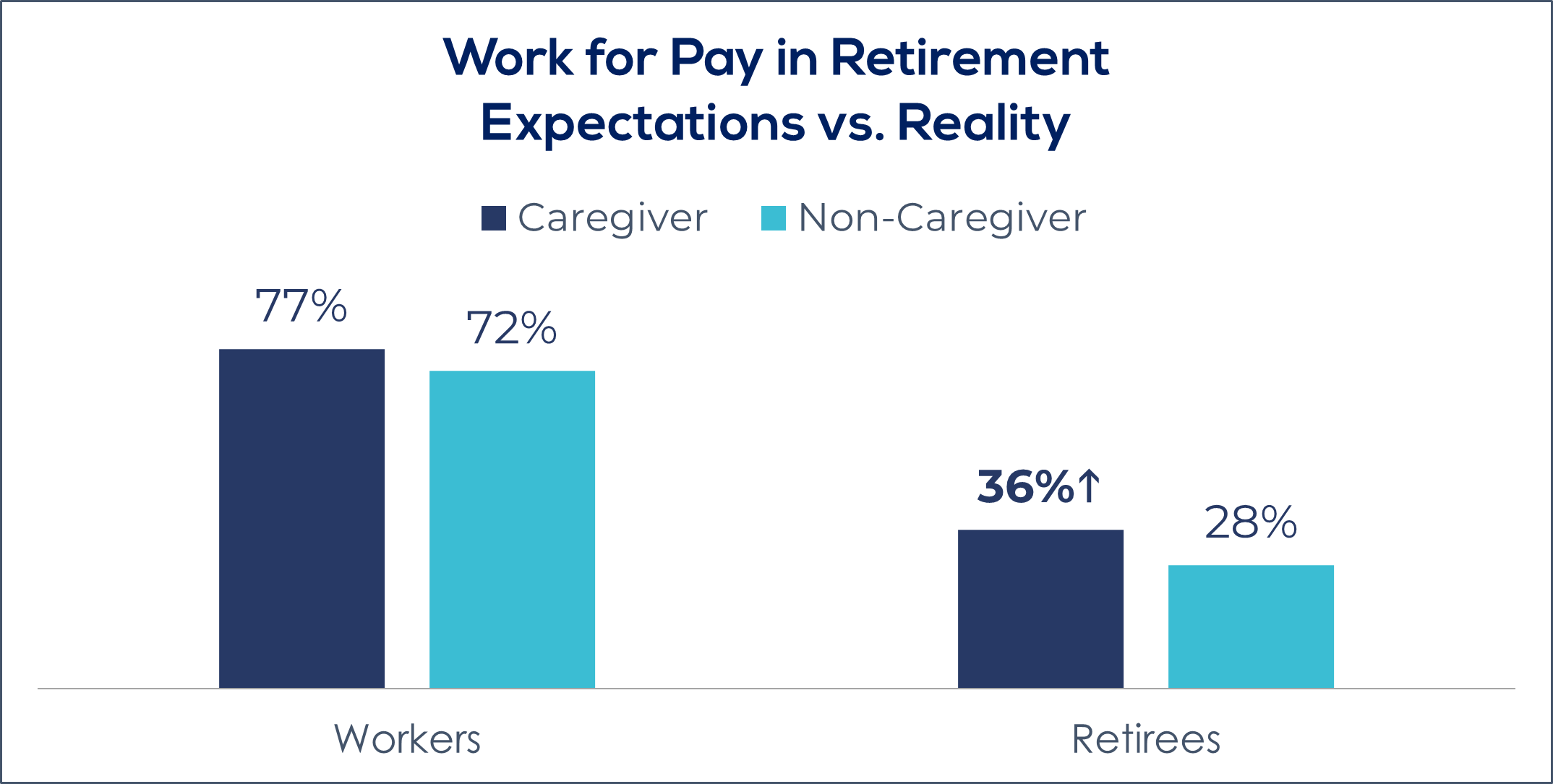

Nonetheless, when asked how much money they need in order to retire, their anticipated savings look similar to what other consumers predict. So how do caregivers plan to make up for their current lack of savings? Nearly four in five working caregivers believe they will go back to work during their retirement years. Historically, we have seen that workers overestimate the possibility that they will work for pay in retirement in comparison to what retirees report they actually do. However, caregivers’ expectations appear more realistic as 36% of retired caregivers say they have worked in retirement, which is significantly more than what non-caregivers report (28%).

Caregivers in Retirement

Some caregivers might be returning to work in retirement due to the fact that they weren’t ready to retire in the first place. Over half of retired caregivers ended up retiring earlier than they planned to. Of the individuals who retired earlier than planned, caregivers are more likely than non-caregivers to say that the reason they retired was out of their control. Specifically, 37% of caregivers did so because of the burdens of caregiving for a family member. Another 36% of those who retired early did so because of a health problem or disability.

However, even in retirement, caregivers’ financial troubles continue. Retired caregivers are more likely than non-caregivers to say that housing expenses, taxes, leisure expenses, providing family financial support, and long-term care are higher than they expected. Taking into account that some caregivers are working while they are supposed to be retired, coupled with higher-than-expected expenses, it’s no wonder that retired caregivers are more likely than non-caregivers to say their overall lifestyle in retirement is worse than they expected. Specifically, 31% of retired caregivers say their retirement lifestyle is worse compared to 20% of non-caregiving retirees.

This continued financial stress throughout their lives is evident as caregivers are more likely to say their emotional well-being is worse compared to non-caregivers. Two-thirds say their mental health is negatively impacted directly because of their caregiving role.

To learn more about the impact caregiving has on consumers’ mental and financial wellbeing, please view the new 2023 RCS Caregivers Report released by Greenwald Research and the Employee Benefit Research Institute (EBRI) or watch Greenwald Research’s Coffee Break on Retirement Confidence and Caregiving.