Retirement Plan Investment Options: Is Crypto Next?

By: Greenwald Research

4/17/2023

The majority of consumers say they want it. Employers are skeptical, anxious, even shocked at the idea. There’s only one major retirement plan provider offering it now – but are cryptocurrency investment options on the horizon?

Even with the industry’s recent dramatic setbacks, the crypto craze remains. Even though they’re considered risky investments, the popularity of cryptocurrencies is undeniable – so much so that they’re being offered in new and different ways to meet the increased demand.

But as an investment option in workplace retirement plans?

Adding crypto as an option would certainly create procedural, educational and fiduciary heartburn for plan sponsors. But it’s also true that while the price of cryptocurrencies has fluctuated greatly over the past few years, their values have ultimately yielded net increases from 2019. That’s drawn the attention of at least some investors who are now interested in purchasing cryptocurrencies as more of an investment strategy than as a short-term gamble.

Taking a Deep Dive to Offer Insight and Track the Trend

To offer some solid insight into what may well become trend, we at Greenwald Research surveyed more than a thousand consumers and conducted in-depth interviews with five employers to gauge the likelihood that crypto investment options will become common in retirement plans. Our Cryptocurrency and Retirement study uncovered a wide range of perspectives on the topic and mixed reactions among different demographic groups and investor types.

But in measuring overall interest, we found a stark difference between consumers and employers. Greenwald Research will be conducting tracking research on these attitudes in 2023 and beyond.

When it burst onto the scene in 2009, cryptocurrency was viewed as something of an oddity in the financial services world and generated little attention from the general public. But interest in this niche digital currency grew – slowly and steadily at first, then explosively in late 2020 when a mix of cultural, social and economic factors drove interest and ownership to unprecedented levels. Cryptocurrency markets have recently experienced dramatic declines from those peaks – but, as we noted above, its value remains above pre-pandemic levels and interest from investors remains intact.

Originally, cryptocurrencies were intended to serve as a form of currency decentralized from traditional financial agencies like the government or banks. But today it’s used for anything from purchasing goods and services to investing and trading. It’s even accepted by some in lieu of salaries or wages.

An Appetite Among Consumers is Developing

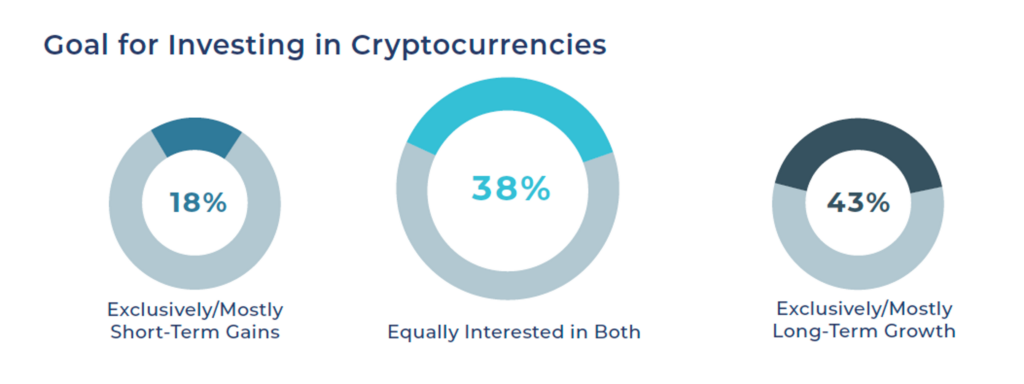

Almost all the consumers we surveyed had heard of cryptocurrency, and more than half said they were extremely or very familiar with it. More than half said they own or have previously owned cryptocurrency. As polarizing a topic as cryptocurrency can be, positive feelings among consumers outweigh negative feelings. More than half said they’re either interested in cryptocurrencies as a retirement investment or are already investing in cryptocurrencies (outside of their employer-sponsored plan) for retirement. More than twice as many consumers said they’re interested in cryptocurrencies for long-term growth than for short-term gain, and a significant percentage said they’re equally interested in both.

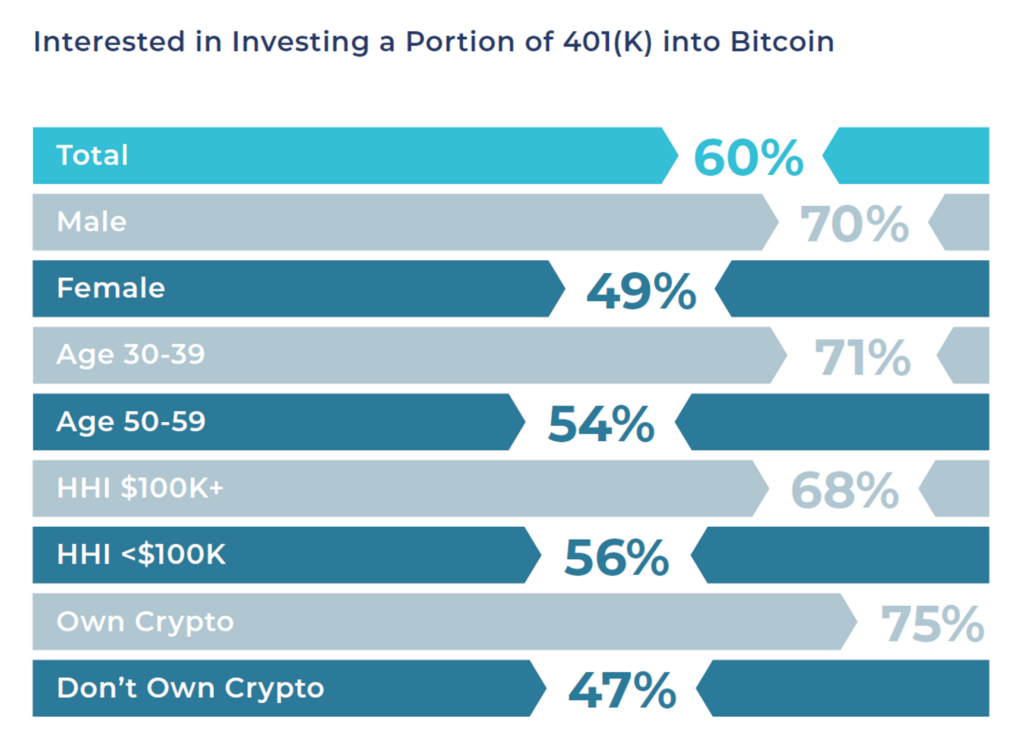

A majority of the consumers we surveyed say they’d be interested in investing a portion of their 401(k) in cryptocurrency – and would make that investment within a few months of that option becoming available.

Fear of Going Where (Almost) No Employer Has Gone Before

Employers we spoke to were, in the main, skeptical to say the least. They felt that offering a cryptocurrency option in their retirement plans would be a daring and aggressive move and wondered how they could protect themselves from liability. Most were extremely apprehensive about entering this uncharted territory. One, however, thought that because a crypto option would be outside the typical offerings, it could be used as a selling point to recruit and retain employees. And nearly all employers said a crypto investment option would positively impact either the level of savings or the level of interest that employees have with their retirement plans.

The bottom line: interest in cryptocurrencies among individual consumers is undeniable – and while that interest skews heavily toward certain demographic groups, overall interest is high. We very likely will not know whether investing in cryptocurrencies for retirement or adding a crypto option to an employer-sponsored retirement plan is a good investment approach until more time has passed, and it will be important to continue to track developments in consumer and employer attitudes.

The Greenwald Research study Cryptocurrency and Retirement is available for purchase by contacting Matt Ceryanec at mattceryanec@greenwaldresearch.com.

We’ve also devoted an episode of our Coffee Break webinar series to Cryptocurrency in Retirement Plans, in which Chief Research Officer Lisa Weber-Raley and Director Matt Ceryanec explain cryptocurrency and its potential use as a retirement investment both in and out of retirement plans. An online video of that webinar is available here.